Chocolate Market Trends: Growth, Segmentation & Key Players 2030

Ever wondered what fuels a multi-billion dollar industry that tantalizes taste buds across the globe? It's the intricate and ever-evolving world of the chocolate market, a sector driven by innovation, consumer preferences, and global economic forces.

Chocolate, derived from roasted cacao seeds, primarily finds its use in confectionery and bakery products. This seemingly simple treat is at the heart of a complex global market, one meticulously segmented by product type, distribution channels, and geographic regions. When considering the product type, the market distinctly bifurcates into white/milk chocolate and dark chocolate, each catering to diverse consumer palates and preferences.

| Category | Details |

|---|---|

| Market Size (2019) | USD 114.33 Billion |

| Projected Market Size (2032) | USD 164.97 Billion |

| CAGR (2019-2032) | 2.98% |

| Market Size (2023) | USD 119.39 Billion |

| CAGR (2024-2030) | 4.1% |

| Market Size (2024) | USD 125 Billion |

| Projected CAGR (2025-2034) | Over 3.3% |

| Premium Chocolate Market (2025) | USD 39.35 Billion |

| Premium Chocolate Market (2030) | USD 58.90 Billion (CAGR 8.40%) |

| Key Players | Ferrero International SA, Mars Incorporated, Mondelz International Inc., Nestl SA, The Hershey Company, Chocoladefabriken Lindt & Sprngli AG, Yildiz Holding |

| Reference | IBISWorld - Chocolate Production in the US - Market Size |

Segmentation of the chocolate market provides a granular view of the diverse categories and opportunities within. Armed with a thorough understanding of these segmentations, entrepreneurs can pinpoint opportunities and tailor strategies for their chocolate ventures, catering precisely to the needs and desires of consumers. This strategic insight is invaluable for companies like "El Triunfo," a chocolate enterprise contemplating international expansion. A detailed macro and microeconomic investigation of the chocolate sector is paramount to charting the best course for internationalization, allowing the company to leverage its extensive product portfolio and venture into new markets.

- Vegamovies Nl Is It Safe Risks Legal Alternatives 2024 Guide

- Movierulz 2025 Watch South Indian Movies Web Series Legally

The global chocolate confectionery market, which held a valuation of USD 114.33 billion in 2019, is projected to soar to USD 164.97 billion by 2032, demonstrating a compound annual growth rate (CAGR) of 2.98% over the forecast period, according to market analysis. This growth trajectory underscores the enduring appeal of chocolate and its capacity to evolve with changing consumer preferences. The secondary sector of chocolate production involves transforming cocoa beans into chocolate through sophisticated machinery after the beans are roasted.

The rise of artisan and craft chocolate creation, coupled with a growing consumer demand for ethically sourced products, is set to fuel industry expansion through 2035. Britain's chocolate sector exemplifies this evolution, adapting to meet the increasing consumer appetite for organic and healthier chocolate options. Advanced equipment, such as the ROKK CCM200 process mixer, traditionally used for dairy, is now employed for mixing chocolate and fillings, enhancing production efficiency and quality. Premium chocolate manufacturers like Lily OBriens have achieved significant production improvements by using the ROKK CCM200 to blend sweet fillings for their luxury chocolate collections.

The global chocolate market is projected to reach USD 114.17 billion in 2025, with a CAGR of 4.95% pushing it to USD 145.33 billion by 2030. Key players such as Ferrero International SA, Mars Incorporated, Mondelz International Inc., Nestl SA, and The Hershey Company dominate the market. Analysis of chocolate market size and trends reveals a dynamic landscape. The global chocolate market size was estimated at USD 119.39 billion in 2023 and is expected to grow at a CAGR of 4.1% from 2024 to 2030. The global chocolate market was valued at USD 125 billion in 2024 and is projected to expand at a CAGR of over 3.3% from 2025 to 2034, driven by increasing disposable incomes in developing countries.

- Zee5 Movierulz Watch Movies Online In Hd Year Guide

- New Telugu Movies 2023 Watch Online Download Legally

Germany's robust gifting culture around holidays and its advanced confectionery sector contribute to a thriving market. Comprehensive market analysis studies and industry reports provide an overview of the chocolate sector, featuring historical data since 2019 and forecasts up to 2030. These reports include detailed market research from numerous companies, enriched with industry statistics, insights, and thorough analysis.

Efforts to expand market share in the global cocoa and chocolate sector are ongoing. Royal Duyvis Wiener, founded in 1885 as a machine factory for cranes, lifts, and bridges, is now a global solution provider in the cocoa and chocolate industry. Nestl's confectionery sector is divided into three categories: chocolate, sugar confectionery, and biscuits, with chocolate being the largest category in 2023.

In Spain, the cocoa and chocolate industry is the top contributor in production value to the confectionery sector, accounting for 27.6% of total production value, and generating more than one in every four euros invoiced by the industry. Over the last three years, the category has seen its turnover increase at an annual rate exceeding 5%. The premium chocolate market is expected to reach USD 39.35 billion in 2025 and grow at a CAGR of 8.40% to USD 58.90 billion by 2030. Major companies operating in this market include Chocoladefabriken Lindt & Sprngli AG, The Hershey Company, Mondelz International, Yildiz Holding, and Ferrero International S.A.

It is imperative to consider the impacts on the environment, society, and economy, as well as the endeavors to sustain the business for the long term. In 2014, chocolate sales grew by 19% in South Korea, 18% in India, 16% in China, and 12% in Vietnam. The global chocolate market faced an increase in cocoa prices in 2014, driven by higher demand, climate change, and crop-affecting pests.

Mars leverages its extensive distribution networks in both developed and emerging markets, positioning itself effectively against its competitors. As a result, the company steadily strengthens its global presence and maintains competitiveness in the dynamic chocolate sector. Lindt & Sprngli has been enchanting the world with chocolate for 180 years and produces quality chocolates today at its 12 own production sites in Europe and the USA.

The nuances of the chocolate market are further highlighted by examining specific regional dynamics and competitive landscapes. For example, the cocoa sector in Ghana plays a pivotal role in supplying raw materials, while the chocolate market in Canada showcases unique consumer preferences and market trends. Leading companies like Lindt & Sprngli, Mondelz International, and The Hershey Company employ distinct strategies to maintain their market dominance. Key figures and essential market indicators provide a comprehensive understanding of the competitive forces at play.

Furthermore, consumer behaviors and preferences significantly shape the trajectory of the chocolate market. In Germany, a robust gifting culture around holidays and a sophisticated confectionery sector create a high-demand environment for chocolate products. This is contrasted by markets such as Britain, where consumers are increasingly seeking organic and healthier chocolate options, pushing manufacturers to innovate and cater to these evolving tastes. Understanding these regional and cultural nuances is critical for companies aiming to succeed in the global chocolate market.

Innovation in production processes is also a key driver of the chocolate industry. Companies are adopting advanced technologies and machinery to enhance efficiency, improve product quality, and reduce costs. The use of equipment like the ROKK CCM200 process mixer, originally designed for the dairy industry, in chocolate production demonstrates this trend. By leveraging such innovations, manufacturers can optimize their operations and meet the growing demand for premium and luxury chocolate products.

The competitive landscape of the chocolate market is characterized by a mix of established multinational corporations and emerging artisan brands. Companies like Ferrero, Mars, Nestl, and Hershey command significant market share due to their extensive distribution networks, strong brand recognition, and diverse product portfolios. However, smaller, craft chocolate makers are gaining traction by focusing on unique flavors, ethically sourced ingredients, and innovative production techniques. This dynamic competition fosters innovation and provides consumers with a wider range of choices.

Ethical sourcing and sustainability are increasingly important considerations in the chocolate industry. Consumers are becoming more aware of the social and environmental impacts of cocoa production, prompting companies to adopt sustainable practices and ensure fair treatment of farmers. Initiatives such as Fairtrade certification and direct sourcing programs are gaining popularity as ways to promote ethical and responsible sourcing. By prioritizing sustainability, chocolate companies can enhance their brand reputation and appeal to socially conscious consumers.

The growth of the chocolate market is also influenced by macroeconomic factors such as rising disposable incomes, urbanization, and changing demographic trends. In emerging markets like China, India, and Vietnam, increasing affluence and exposure to global brands are driving demand for chocolate products. As these countries continue to develop, the chocolate market is expected to experience significant growth. Furthermore, demographic shifts, such as an aging population in developed countries, are influencing product preferences and consumption patterns.

The COVID-19 pandemic has had a mixed impact on the chocolate market. While initial lockdowns and supply chain disruptions posed challenges, the increased demand for comfort foods and at-home consumption boosted sales in some segments. E-commerce channels experienced significant growth as consumers shifted their purchasing habits online. As the pandemic subsides, the chocolate market is expected to recover and continue its growth trajectory, driven by both pent-up demand and long-term trends.

Looking ahead, the chocolate market is poised for continued growth and innovation. The rise of functional chocolates, infused with health-promoting ingredients, is one trend to watch. Personalized chocolate experiences, enabled by digital technologies, are also gaining traction. As the market evolves, companies that can adapt to changing consumer preferences, embrace sustainability, and leverage innovation will be best positioned for success. The global chocolate market, therefore, remains a fascinating and dynamic sector, offering both challenges and opportunities for those who understand its complexities.

The future of the chocolate industry hinges on a delicate balance of innovation, ethical practices, and responsiveness to global consumer trends. Companies that prioritize these factors will not only thrive but also contribute to a more sustainable and equitable chocolate ecosystem. The journey from cocoa bean to delectable treat is a complex one, and the ongoing evolution of the market promises exciting developments for producers, consumers, and the world at large.

Innovation continues to be a cornerstone for success, with manufacturers exploring novel flavors, textures, and product formats. This includes the incorporation of unconventional ingredients, such as spices, herbs, and even savory elements, to create unique and memorable eating experiences. Furthermore, the rise of vegan and plant-based chocolates caters to an expanding segment of health-conscious consumers, driving demand for alternative formulations and ingredients.

Ethical sourcing remains paramount as consumers increasingly scrutinize the origins and production methods of their chocolate. Companies are under pressure to ensure that cocoa farmers receive fair compensation, child labor is eradicated, and sustainable agricultural practices are employed. Transparency in the supply chain is essential, with initiatives like traceability systems and direct trade partnerships helping to build trust and accountability.

The digital realm plays an increasingly significant role in shaping consumer preferences and purchasing behaviors. E-commerce platforms provide convenient access to a wide array of chocolate products, while social media channels serve as powerful tools for brand promotion and consumer engagement. Personalized marketing campaigns, tailored to individual tastes and preferences, are becoming more prevalent, enhancing the customer experience and driving sales.

Despite the positive growth outlook, the chocolate industry faces several challenges. Climate change poses a significant threat to cocoa production, with rising temperatures and erratic rainfall patterns impacting crop yields. Pests and diseases can also decimate cocoa harvests, leading to supply shortages and price volatility. Furthermore, competition from alternative snacks and confectionery products remains intense, requiring chocolate manufacturers to continuously innovate and differentiate their offerings.

The regulatory landscape also presents challenges for chocolate companies. Health and nutrition regulations, such as labeling requirements and restrictions on sugar content, can impact product formulations and marketing strategies. Trade policies and tariffs can also affect the competitiveness of chocolate exports and imports. Navigating these complex regulatory environments requires careful planning and compliance efforts.

Despite these challenges, the chocolate industry remains resilient and adaptable. Companies are investing in research and development to develop climate-resilient cocoa varieties, improve farming practices, and enhance the nutritional profile of their products. Collaboration among industry stakeholders, including governments, NGOs, and farmer organizations, is also crucial for addressing the systemic challenges facing the cocoa sector.

In conclusion, the global chocolate market is a dynamic and complex ecosystem shaped by a multitude of factors, including consumer preferences, economic trends, technological innovation, and ethical considerations. Companies that can navigate these complexities and adapt to changing circumstances will be well-positioned to thrive in this competitive landscape. As the world's love affair with chocolate endures, the industry must embrace sustainability, transparency, and innovation to ensure its long-term prosperity and positive impact on society.

- Ray Chen Discover His Life Music Relationships Hot Scoop

- Vegamovies Nl Is It Safe Risks Legal Alternatives 2024 Guide

4 ways guilt free indulgence is changing the chocolate sector Food

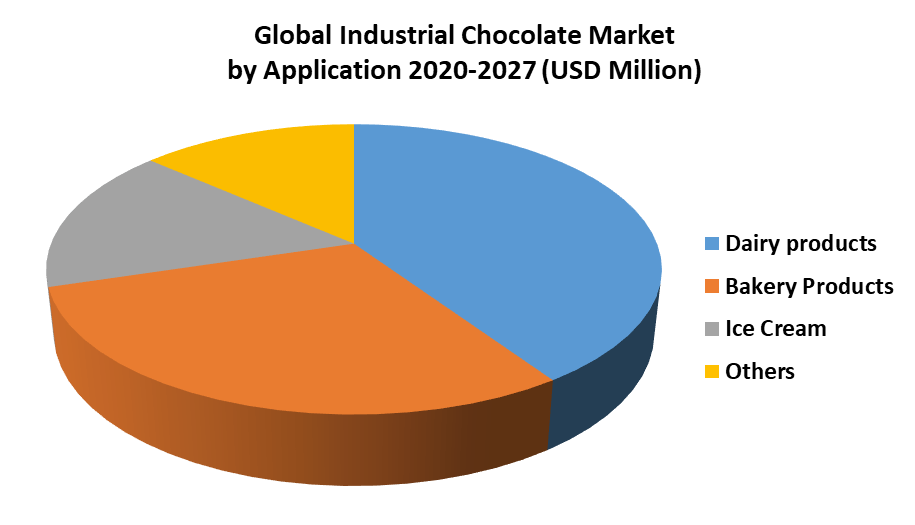

Global Industrial Chocolate Market Industry (2021 2027)

Industria del chocolate el dulce sabor de la manufactura mexicana