Chocolate Market Analysis: Trends, Growth & Key Players [2024]

Ever wondered how the humble cocoa bean transforms into a global phenomenon worth billions? The chocolate sector isn't just about satisfying sweet cravings; it's a complex interplay of economics, agriculture, and consumer trends that shapes industries worldwide.

From the meticulous cultivation of cocoa in West Africa to the innovative product development labs of Switzerland and the United States, the journey of chocolate is a testament to human ingenuity and global interconnectedness. Understanding the intricacies of this sector requires a deep dive into market segmentation, competitive landscapes, and the ever-evolving tastes of consumers across different continents. This article navigates the multifaceted world of chocolate, offering insights into its past, present, and future, with a keen focus on the economic forces driving its growth and the key players shaping its trajectory.

| Aspect | Details |

|---|---|

| Sector Overview | Global cocoa and chocolate sector |

| Key Players | Lindt & Sprngli, Hershey, Mondelz, Ferrero, Mars |

| Market Size (2023) | Estimated at USD 119.39 billion |

| Projected Growth (CAGR) | 4.1% from 2024 to 2030 |

| Growth Drivers | Increasing disposable income, artisan chocolate creation, ethical sourcing |

| Major Segments | White/milk chocolate, dark chocolate |

| Geographic Focus | Europe, USA, developing countries (India, China, Vietnam) |

| Sustainability Efforts | Focus on social and environmental areas essential to a sustainable sector |

| Reference | International Cocoa Organization (ICCO) |

A Spanish study indicates that the Spanish cocoa and chocolate industry is a primary contributor, accounting for 27.6% of the sweet sector's production value. This signifies that it generates more than one in every four euros invoiced by the industry. In recent years, this category has seen a revenue increase at an annual rate exceeding 5%.

- Morgpies Rise Exploring Twitchs Topless Meta Lsf Reaction

- Kannada Box Office Highest Grossing Kannada Films Of 2024 Ranked

The premium chocolate market is anticipated to reach USD 39.35 billion in 2025 and is projected to grow at a CAGR of 8.40%, reaching USD 58.90 billion by 2030. Key companies operating in this market include Chocoladefabriken Lindt & Sprngli AG, The Hershey Company, Mondelz International, Yildiz Holding, and Ferrero International S.A.

Chocolate, derived from roasted cocoa seeds, is primarily used in confectionery and bakery products. The global chocolate market is segmented by product type, distribution channel, and geography. Product types include white/milk chocolate and dark chocolate.

Market segmentation provides a detailed look at the various categories and opportunities within the chocolate sector, which is vital for entrepreneurs looking to identify opportunities and develop strategies for their chocolate ventures.

- Kannada Movies 2024 Watch Online Legally Avoid Movierulz

- Yumieto Leak The Controversy Impact Whats Next

The global chocolate confectionery market was valued at USD 114.33 billion in 2019 and is projected to reach USD 164.97 billion by 2032, exhibiting a CAGR of 2.98% during the forecast period. This analysis is based on existing reports.

In the secondary sector of chocolate production, cocoa beans are processed into chocolate by machinery. The beans are first roasted, then refined.

The rise of artisan and craft chocolate, coupled with the demand for ethically sourced goods, will continue to drive industry expansion through 2035. The British chocolate sector is evolving to meet consumer preferences for organic and healthier chocolate options.

Equipment like the ROKK CCM200 process mixer, traditionally used for dairy, is now being utilized for mixing chocolate and fillings. Premium chocolate manufacturer Lily OBriens has improved production by using the ROKK CCM200 to mix fillings for its luxury chocolate collections.

The global chocolate market is expected to reach USD 114.17 billion in 2025 and grow at a CAGR of 4.95% to reach USD 145.33 billion by 2030. The major companies in this market include Ferrero International SA, Mars Incorporated, Mondelz International Inc., Nestl SA, and The Hershey Company.

In 2023, the global chocolate market was estimated at USD 119.39 billion and is anticipated to grow at a CAGR of 4.1% from 2024 to 2030.

Each year, chocolate companies, traders, processors, manufacturers, and retailers are invited to report on progress in areas critical to a sustainable sector. This allows the sector to assess and improve sustainability practices.

Revenue in the chocolate confectionery market is projected to reach USD 140.12 billion in 2025. The global chocolate market, valued at USD 125 billion in 2024, is projected to expand at over a 3.3% CAGR from 2025 to 2034, driven by increasing disposable income in developing countries. The global chocolate confectionery market was valued at USD 114.33 billion in 2019 and is projected to reach USD 164.97 billion by 2032, showing a CAGR of 2.98% during the forecast period.

These efforts consider the impacts on the environment, society, and economy, as well as the commitment to sustaining the business for the long term.

In 2014, chocolate sales increased by 19% in South Korea, 18% in India, 16% in China, and 12% in Vietnam. The global chocolate market faced rising cocoa prices due to increased demand, climate change, and crop-affecting pests.

The major key figures provide insight into Lindt & Sprngli, Mondelz International, and The Hershey Company.

Mars leverages its distribution networks in developed and emerging markets, strengthening its global presence and competitiveness in the chocolate sector.

Lindt & Sprngli has been enchanting the world with chocolate for 180 years, producing quality chocolates at its 12 production sites in Europe and the USA.

The confectionery sector at Nestl is organized into three primary categories: chocolate, sugar confectionery, and biscuits. In 2023, chocolate represented Nestl's largest confectionery segment.

The influence of the cocoa sector in Ghana and the chocolate market in Canada also highlight the diverse geographic impacts on the global industry.

The Chocolate Room in Chandigarh, Sector 7, offers a local perspective on chocolate consumption. For instance, "Chocolates El Rey," "La Casa del Chocolate," and "Alimento de los Dioses" showcase local chocolate businesses.

One notable example is "El Triunfo," a chocolate company undergoing research at both macro and microeconomic levels to determine the best internationalization strategy. With a strong product portfolio, the company is considering expanding into new markets.

- Jason Kelces Daughter Down Syndrome Truth Family Life

- Movierulz 2025 Watch Latest South Indian Movies More Online

4 ways guilt free indulgence is changing the chocolate sector Food

:max_bytes(150000):strip_icc()/The-world-of-chocolate-ma-009-58b886fb3df78c353cbec67a.jpg)

The Who, What and Where of the Global Chocolate Industry

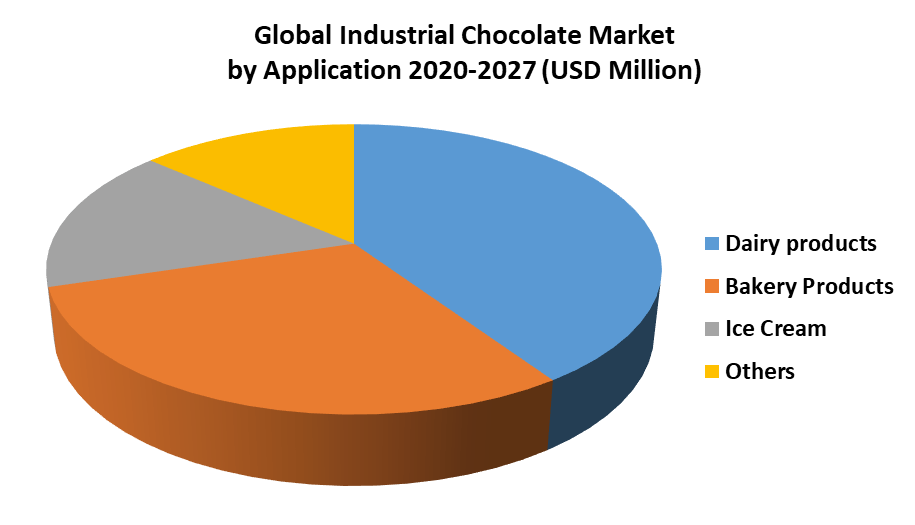

Global Industrial Chocolate Market Industry (2021 2027)